This week is the second part of a 3-part topic focussed on developing a Cost of Sales Budget for the next financial year. Last week we looked at Cost of Sales – Materials, now the objective is to determine the Cost of Sales – Direct Labour for your budgeted sales.

The definition of direct labour in a cost of sales context for both products (Cost of Goods Sold) and services (Cost of Services) is the labour that ‘touches’ or ‘adds value’ to the product or service produced and which varies directly with the volume of production of the product or service . It is effectively the variable labour required to produce a product or service, but excludes supervision and support departments. Note that this week’s topic is not relevant to import/distribution/reseller entities that don’t produce goods or services.

The labour cost components to be included in your direct labour costs include not only the wage/salary of the direct employee but also overtime, shift allowances and bonuses etc, plus oncosts such as workcover, payroll tax, superannuation and leave provisions. You also need to ensure that you reflect EBA (Enterprise Bargaining Agreement) or budget wage rate increases in your budget dollars.

Calculating how many direct labour personnel headcount, and hence dollars, are to be included in your direct labour budget is the next task.

MANUFACTURER/SERVICE PROVIDER – IF YOU HAVE LABOUR ROUTINGS BY PRODUCT/SERVICE

If you have a computer system, or excel spreadsheets that you use for labour routings by product/service showing how many hours it takes to setup and produce the product/service across the various production work centres, you can extrapolate these hours by the volumes of sales budget to come up with budgeted productive direct labour hours. This can then be converted back to labour heads and hence direct labour hours. Don’t forget to factor in non-productive down-time and vacations.

You then need to consider efficiency improvements you may have included as part of your strategic planning process and reflect those in your direct labour budget also.

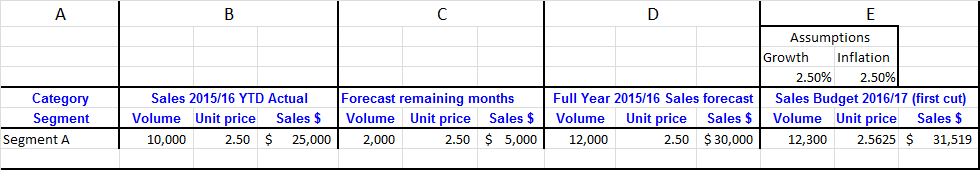

Once the heads are determined, you need to determine the budget cost of the direct labour personnel. Multiply your budgeted direct labour headcount by the annual cost of each direct labour head (including oncosts noted above). Note that you can then derive ‘budget labour recovery rates’ for your work centres and ‘push’ back into your labour routes so as to build up budget direct labour costs by product/service, refer Figure 1, column K.

MANUFACTURER/SERVICE PROVIDER – IF YOU DON’T HAVE LABOUR ROUTINGS

If don’t have a labour routing system, you are best to look at using the actual current year-to-date (YTD) volumes and actual direct labour YTD as a starting point and pro-rata direct labour costs for the volume movements between current year forecasts and budgeted volumes for next year. Factor in wage/inflation increases but also reflect any productivity initiatives you have identified in your strategic planning process to give you a direct labour budget.

START-UP MANUFACTURER/SERVICE PROVIDER

If you are a start-up, hopefully your research will have identified the direct labour resources you will need to deliver your product/services based on your budgeted volumes. Put some values around the headcount requirement for direct labour to produce your product/service for the financial year by applying annual labour cost including overtime (including premium), shift allowances, bonuses, superannuation, payroll tax and workcover.

Use this week to develop the second component of your Cost of Sales budget, your Direct Labour Budget for the next financial year, to provide a sound foundation for business success.

As always, if you need some help or guidance, don’t hesitate to call me on (03) 9554-3128.

Next week we move to the third part of the Cost of Sales budget, Direct Variable Expenses, after which you will be able calculate another key metric: Gross Margin.

Ross